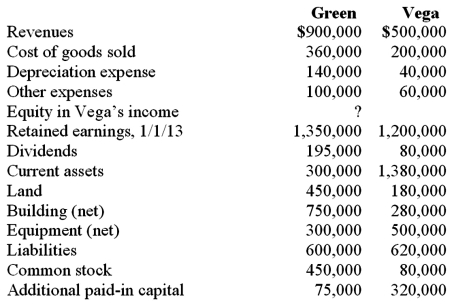

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013, consolidated revenues.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013, consolidated revenues.

Definitions:

Organizational Stories

Are narratives shared among members of an organization that embody its values, history, and culture.

Performance Standards

The expected levels of performance that set the benchmarks for quality or success in work tasks or goals.

Organizational Culture

The shared values, beliefs, and practices that shape the behavior and attitudes of individuals within an organization, influencing its functioning and performance.

Social Control

Mechanisms, strategies, and structures within a society or group to regulate individual behavior and maintain social order.

Q5: Acker Inc. bought 40% of Howell Co.

Q14: On January 1, 2010, Mehan, Incorporated purchased

Q23: What is preacquisition income?

Q44: Webb Company owns 90% of Jones Company.

Q51: How should an investor account for, and

Q77: Pell Company acquires 80% of Demers Company

Q82: Perry Company acquires 100% of the stock

Q105: The following information has been taken from

Q107: When a company has preferred stock in

Q115: How are bargain purchases accounted for in