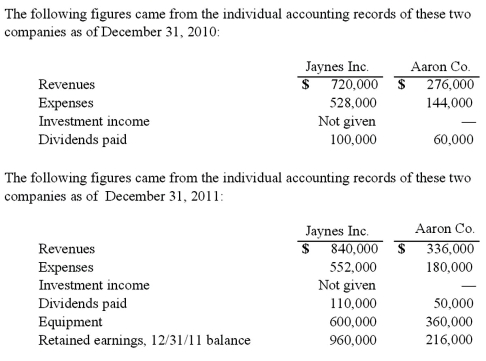

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.  What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2010, when the equity method was applied for this acquisition?

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2010, when the equity method was applied for this acquisition?

Definitions:

Cephalothorax

A body region found in certain arthropods, including spiders and crustaceans, that combines the head and the thorax into one unit.

Fangs

Long, pointed teeth typically found in venomous snakes used to inject venom, or in some mammals for grasping and tearing.

Deuterostome

Group of coelomate animals in which the second embryonic opening is associated with the mouth; the first embryonic opening, the blastopore, is associated with the anus.

Notochord

A flexible rod made out of a material similar to cartilage that provides support in all embryonic and some adult chordate animals.

Q10: The utterance "The girls are playing with

Q12: Cayman Inc. bought 30% of Maya Company

Q61: On January 1, 2010, Mace Co. acquired

Q85: Clemente Co. owned all of the voting

Q88: Watkins, Inc. acquires all of the outstanding

Q88: Several years ago Polar Inc. acquired an

Q94: On January 4, 2011, Watts Co. purchased

Q105: Femur Co. acquired 70% of the voting

Q109: Wilson owned equipment with an estimated life

Q113: McGuire Company acquired 90 percent of Hogan