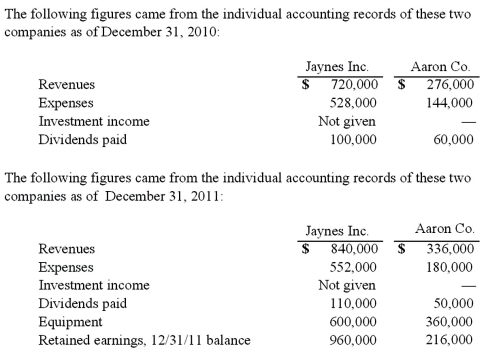

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.  What was consolidated net income for the year ended December 31, 2011?

What was consolidated net income for the year ended December 31, 2011?

Definitions:

Culturally-Informed Identities

Identities that are understood and shaped within the context of cultural backgrounds, acknowledging the influence of cultural norms and values.

Multicultural Therapies

Psychotherapy approaches that recognize and address the diverse cultural backgrounds of clients, incorporating cultural knowledge and sensitivity into treatment.

Identity Politics

An approach to politics or activism that focuses on issues relevant to various social and cultural identities, including race, gender, and sexuality.

Clinical Trials Research

The systematic study designed to evaluate the effects and safety of medications or medical devices by monitoring their outcomes on large groups of people.

Q7: Most children demonstrate emergent literacy skills by

Q12: Beatty, Inc. acquires 100% of the voting

Q17: In most people,the right hemisphere is dominant

Q38: Which of the following is not an

Q66: The balance sheets of Butler, Inc. and

Q71: Which one of the following characteristics of

Q79: On January 1, 2011, Musial Corp. sold

Q83: Bauerly Co. owned 70% of the voting

Q95: Which of the following statements is true

Q118: Pot Co. holds 90% of the common