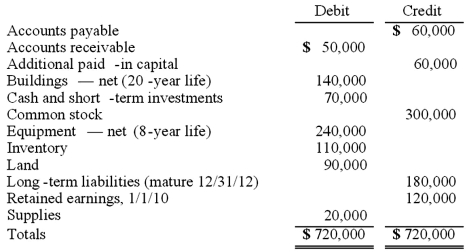

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2010. As of that date, Jackson had the following trial balance:  During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

During 2010, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2011, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2010, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2010.

(B.) Prepare consolidation worksheet entries for December 31, 2011.

Definitions:

Neuron

A specialized cell transmitting nerve impulses; a nerve cell.

Insulation

Insulation refers to materials used to reduce the rate of heat transfer, or the method of installing such materials to help maintain a desired temperature in buildings or protective clothing.

Proximate Explanation

An explanation that focuses on the immediate cause or mechanism of a biological trait or behavior.

Singing

The act of producing musical sounds with the voice, often characterized by a distinct pitch, rhythm, and a series of notes that sound pleasing to the listener.

Q19: Mary can tell you the sound the

Q23: Which of the following statements is false

Q28: On January 1, 2010, Mehan, Incorporated purchased

Q36: Wilson owned equipment with an estimated life

Q45: Pell Company acquires 80% of Demers Company

Q45: On January 1, 2011, Anderson Company purchased

Q69: Pell Company acquires 80% of Demers Company

Q71: On January 1, 2010, Jannison Inc. acquired

Q78: Stiller Company, an 80% owned subsidiary of

Q91: Pell Company acquires 80% of Demers Company