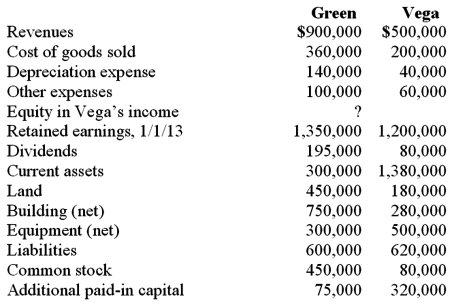

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the book value of Vega at January 1, 2009.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the book value of Vega at January 1, 2009.

Definitions:

Personality

The combination of characteristics or qualities that form an individual's distinctive character.

Sales Tax

A tax paid to a governing body for the sales of certain goods and services, typically a percentage added to the total sale price.

Consumer Need

A requirement essential for a consumer's survival or well-being, which drives purchasing behavior and product demand.

Satisfy

To meet the needs or fulfil the desires, expectations, or requirements of someone or something.

Q3: In a step acquisition, which of the

Q5: The phoneme /f/ is a linguadental speech

Q8: On January 1, 2011, Parent Corporation acquired

Q10: The County Hospital decides to screen the

Q17: Slight variations in our genomes that are

Q54: Pursley, Inc. acquires 10% of Ritz Corporation

Q83: Carnes has the following account balances as

Q89: On January 1, 2010, Mace Co. acquired

Q101: What argument could be made against the

Q117: What is the difference in consolidated results