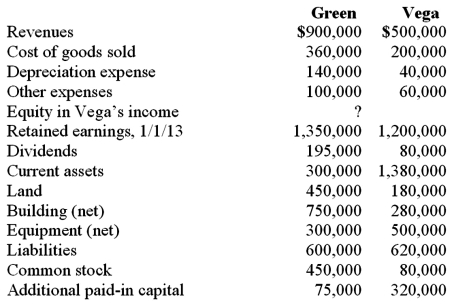

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013, consolidated common stock.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013, consolidated common stock.

Definitions:

Life Expectancy

The average period that an individual is expected to live, based on statistical analysis of current mortality trends.

75-year-old

Referring to an individual or the state of being seventy-five years of age.

Geographic Areas

Defined regions or spaces on the Earth's surface, identified by natural or artificial boundaries.

Elder-friendly Dwellings

Housing designed to accommodate the specific needs of older adults, featuring accessible facilities and safety modifications.

Q2: Pell Company acquires 80% of Demers Company

Q10: The County Hospital decides to screen the

Q13: Panton, Inc. acquired 18,000 shares of Glotfelty

Q15: Developmental dysarthria is most commonly associated with

Q18: Craig is 8 years old and has

Q22: What is the partial equity method? How

Q43: What are the essential criteria for including

Q46: How are direct combination costs accounted for

Q47: A parent acquires all of a subsidiary's

Q111: Which of the following statements is true