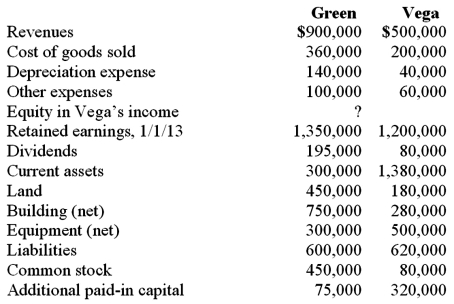

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2013. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013 consolidated retained earnings.

Green acquired 100% of Vega on January 1, 2009, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2009, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment. Compute the December 31, 2013 consolidated retained earnings.

Definitions:

Determined Behavior

Actions that are influenced or controlled by external or internal factors, rather than by free will.

Absolutist Perspective

A viewpoint that believes in absolute principles in political, ethical, or philosophical matters, with no room for relative interpretations.

Visible Disability

A physical or health condition that is clearly apparent or visible to others and may affect an individual's interaction or accessibility in society.

Positivist Social Scientist

A researcher who applies empirical, scientific methods and quantitative analysis to study and understand social phenomena and behaviors.

Q14: Dialects are rule-governed linguistic systems.

Q29: Stiller Company, an 80% owned subsidiary of

Q38: Which of the following is not an

Q70: Flynn acquires 100 percent of the outstanding

Q81: On January 1, 2010, Dawson, Incorporated, paid

Q86: Yaro Company owns 30% of the common

Q99: Bullen Inc. acquired 100% of the voting

Q110: Velway Corp. acquired Joker Inc. on January

Q111: According to GAAP regarding amortization of goodwill

Q112: Which of the following statements is true