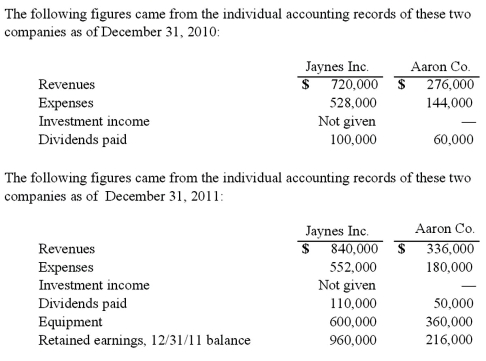

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.  What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2010, when the equity method was applied for this acquisition?

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2010, when the equity method was applied for this acquisition?

Definitions:

Powerful Winds

Strong air movements within the Earth's atmosphere, which can result from various meteorological phenomena and influence weather patterns and climate.

Prairies

Extensive areas of flat or gently undulating grassland, especially in North America, with few if any trees, known for their rich soils and diverse ecosystems.

East And West Coasts

Refers to the eastern and western coastal regions of a continent, often used in context with the United States.

Canada's Southern Border

The geopolitical boundary that separates Canada from the United States, running along the 49th parallel north for much of its length.

Q2: James heard the sentence "the player who

Q14: Walsh Company sells inventory to its subsidiary,

Q15: Audiologists and speech-language pathologists work in educational

Q15: Constructing pedigrees for a family that has

Q19: Speech-language pathologists may describe articulation and phonological

Q23: Which of the following statements is false

Q34: What would differ between a statement of

Q68: Prevatt, Inc. owns 80% of Franklin Company.

Q77: Pell Company acquires 80% of Demers Company

Q121: Racer Corp. acquired all of the common