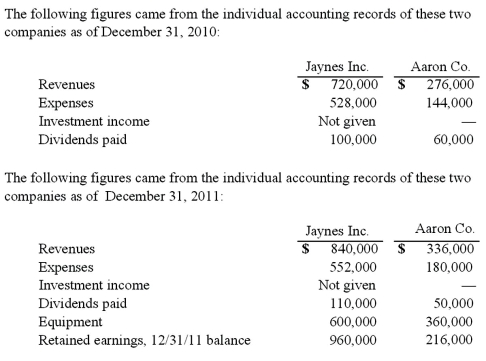

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.  What was the total for consolidated patents as of December 31, 2011?

What was the total for consolidated patents as of December 31, 2011?

Definitions:

Shareholders' Wealth

The total value of a company to its shareholders; typically measured by market capitalization or the value of shares held.

Managers

Individuals responsible for directing and overseeing the operations and employees of an organization or a part of an organization.

Non-Profit Firms

Organizations that operate for purposes other than generating profit, focusing on a specific social cause or advocacy.

Employee Incentives

Programs or rewards designed to motivate employees and align their actions with organizational goals.

Q1: In addition to dysarthria,children with cerebral palsy

Q1: Excessive interruptions of speech increase stuttering.

Q10: Genes<br>A)A set of 46 rod-like structures in

Q11: Pot Co. holds 90% of the common

Q14: In reporting consolidated earnings per share when

Q16: Jones refers his patient for a speech

Q17: Slight variations in our genomes that are

Q28: Davidson, Inc. owns 70 percent of the

Q103: Pepe, Incorporated acquired 60% of Devin Company

Q111: Flynn acquires 100 percent of the outstanding