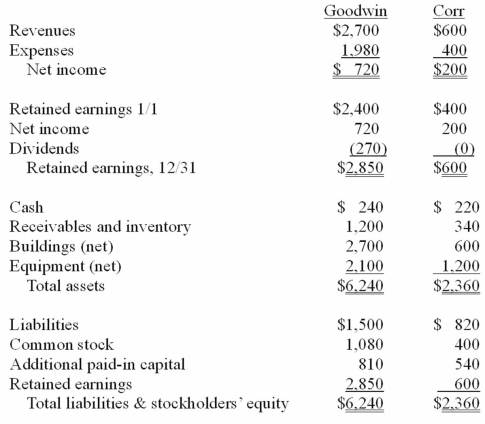

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated expenses for 20X1.

Definitions:

Limited Distribution

A strategic choice by a company to offer its products or services at a select few outlets, often to maintain exclusivity or control over the brand image.

Marchesa Wedding Gown

A high-end bridal dress designed by the luxury fashion brand Marchesa, known for its elegant and elaborate designs.

Secret Antiperspirant

A branded personal care product designed to prevent perspiration and body odor.

Derived Demand

Demand for a product or service that arises from the demand for another product or service.

Q6: When consolidating a subsidiary under the equity

Q8: A statutory merger is a(n)<br>A) business combination

Q12: Cayman Inc. bought 30% of Maya Company

Q17: When consolidating a subsidiary that was acquired

Q20: Juan experiences difficulty with recognizing shifts in

Q23: What is preacquisition income?

Q57: One company buys a controlling interest in

Q61: All of the following statements regarding the

Q78: Stiller Company, an 80% owned subsidiary of

Q96: McGuire Company acquired 90 percent of Hogan