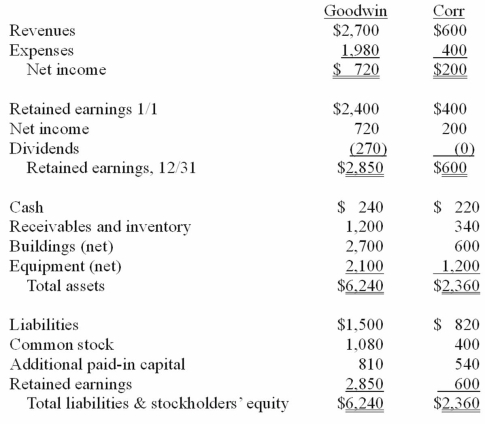

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated cash account at December 31, 20X1.

Definitions:

Q10: High vocal pitch is related to<br>A)Slow moving,short,thick

Q12: Research linking genetics with communication disorders include

Q15: A language milestone appearing during the infant

Q76: Goehler, Inc. acquires all of the voting

Q77: On 4/1/09, Sey Mold Corporation acquired 100%

Q89: Kaye Company acquired 100% of Fiore Company

Q90: Pell Company acquires 80% of Demers Company

Q92: Walsh Company sells inventory to its subsidiary,

Q92: Denber Co. acquired 60% of the common

Q114: Tower Inc. owns 30% of Yale Co.