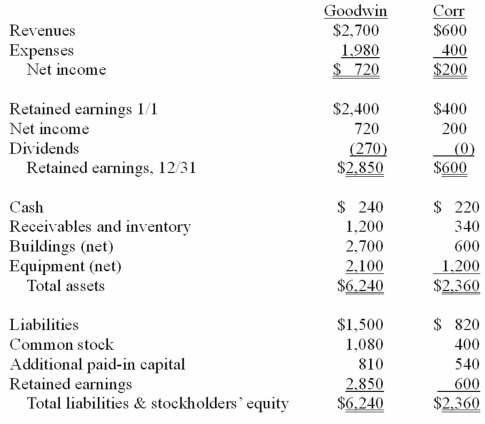

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated liabilities at December 31, 20X1.

Definitions:

Cooperative

An organization consisting of people who pool their resources to buy and sell more efficiently than they could individually.

Single-Owner

Pertains to a business that is exclusively owned by one individual who is responsible for its operations and liabilities.

Business Organization

An entity formed for the purpose of carrying out commercial enterprise, including options such as sole proprietorships, partnerships, and corporations.

Partnership

A legal form of business operation where two or more individuals share ownership, as well as the responsibility for managing the business and the sharing of its profits and losses.

Q6: The word "jumping" has free and bound

Q11: Factors that should be considered in determining

Q12: Beatty, Inc. acquires 100% of the voting

Q12: Evidence-based practice refers to the application of<br>A)Research

Q13: A communication disorder<br>A)Interferes with transmission of the

Q13: A language milestone characteristic of the toddler

Q18: Amy's AAC system seemed to be a

Q19: The swallowing evaluation will be conducted in

Q46: Jans Inc. acquired all of the outstanding

Q49: How is the fair value allocation of