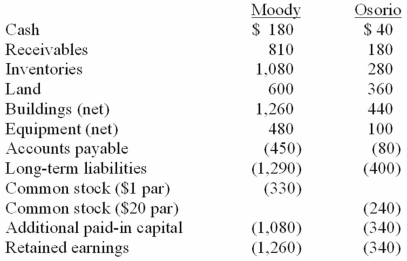

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated additional paid-in capital at date of acquisition.

Definitions:

Clattering

The act of making a series of loud, rattling sounds, as when objects strike against each other.

Hue

A color or shade, the aspect of color which is determined by the wavelength of light.

Wavelength

The distance between successive crests of a wave, especially points in a sound wave or electromagnetic wave, which determines its color and energy.

Physical Characteristics

The observable attributes or features of an organism, such as height, eye color, and body type.

Q5: The speech-language pathologist will screen the speech

Q34: Flintstone Inc. acquired all of Rubble Co.

Q40: How does a gain on an intra-entity

Q82: Perry Company acquires 100% of the stock

Q86: Yaro Company owns 30% of the common

Q87: For an acquisition when the subsidiary maintains

Q87: Under the equity method, when the company's

Q94: MacHeath Inc. bought 60% of the outstanding

Q98: On January 1, 2009, Rand Corp. issued

Q117: On January 1, 2011, Jackie Corp. purchased