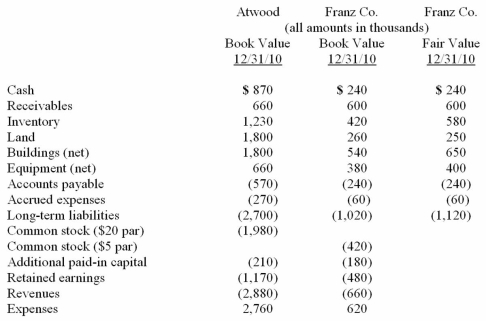

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated buildings (net) at date of acquisition.

Definitions:

Motion To Dismiss

A legal filing requesting that a court dismiss a case for reasons such as lack of jurisdiction, failure to state a claim, or other legal defenses.

Relevant

Pertains to the matter at hand, having significant and demonstrable bearing on the facts or issues.

Probability

A measure of the likelihood or chance that a particular event will occur, often expressed as a number between 0 and 1, where 0 indicates impossibility and 1 indicates certainty.

Deposition

A sworn, out-of-court testimony of a witness that is used for gathering information and evidence in legal proceedings.

Q2: Sociolinguistics<br>A)The study of language acquisition<br>B)The study of

Q13: To teach the scanning method of symbol

Q19: Patients with sensorineural hearing loss are considered

Q20: On January 1, 2011, Pride, Inc. acquired

Q30: Following are selected accounts for Green Corporation

Q45: Flynn acquires 100 percent of the outstanding

Q62: When a parent uses the initial value

Q76: Charlie Co. owns 30% of the voting

Q92: Cayman Inc. bought 30% of Maya Company

Q115: How are bargain purchases accounted for in