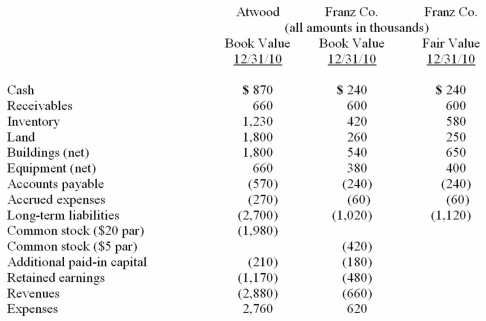

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated equipment at date of acquisition.

Definitions:

Nasogastric Tube

A flexible tube passed through the nose into the stomach for feeding or drainage.

Abdominal Assessment

Abdominal assessment involves the examination of the abdomen by healthcare professionals to identify potential abnormalities, pain, or diseases related to the gastrointestinal system.

Intermittent Suction

A method of applying and releasing suction at intervals to drain bodily fluids, often used in medical settings.

Level Of Consciousness

A measure of a person's wakefulness, awareness, and responsiveness to stimuli and their environment.

Q13: How is a non-controlling interest in the

Q15: Silent aspiration occurs when a patient<br>A)Is unaware

Q15: Cayman Inc. bought 30% of Maya Company

Q33: On January 1, 2010, Palk Corp. and

Q63: Steven Company owns 40% of the outstanding

Q64: McGuire Company acquired 90 percent of Hogan

Q74: Harrison, Inc. acquires 100% of the voting

Q81: X-Beams Inc. owned 70% of the voting

Q88: Watkins, Inc. acquires all of the outstanding

Q103: Pepe, Incorporated acquired 60% of Devin Company