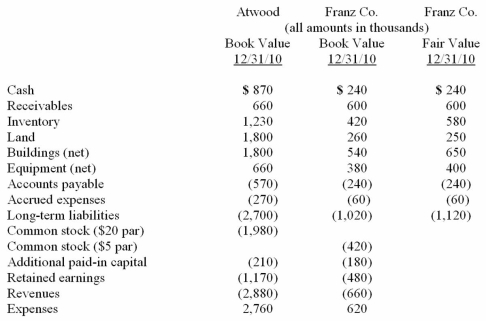

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute the consolidated cash upon completion of the acquisition.

Definitions:

Nationality

The status of belonging to a particular nation, either by birth or naturalization, indicating a person's legal relationship with a state.

Gender

The range of characteristics pertaining to, and differentiating between, masculinity and femininity.

Perceptual Phenomenon

Aspects of observation and cognition that involve the interpretation of sensory information, leading to unique perceptions of reality.

Implicit Personality Theory

The assumptions or beliefs people have about how personality traits are connected and how they manifest in behavior.

Q1: The most frequently occurring communication disorders are

Q3: Children with Down's Syndrome often present with

Q5: Interpret this audiogram<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1407/.jpg" alt="Interpret this audiogram

Q9: The speech-language pathologist decides to participate in

Q14: Walsh Company sells inventory to its subsidiary,

Q16: The quality of voice cannot be completely

Q20: The purpose of communication for persons with

Q42: On January 1, 2011, Pride, Inc. acquired

Q43: Pritchett Company recently acquired three businesses, recognizing

Q82: Johnson, Inc. owns control over Kaspar, Inc.