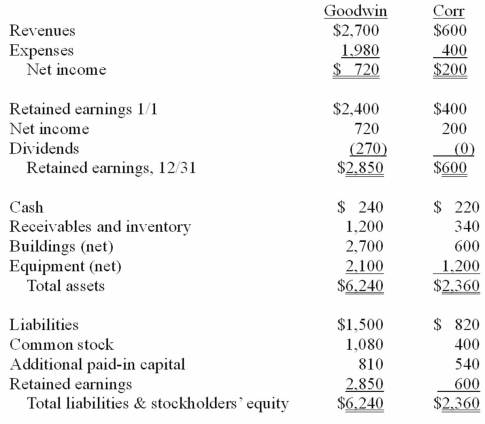

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

In this acquisition business combination, what total amount of common stock and additional paid-in capital is recorded on Goodwin's books?

Definitions:

Insurance Corporation

A company that offers insurance policies to individuals or other entities, covering a range of risks.

Employee Benefits Package

A collection of non-wage compensations provided to employees in addition to their normal wages or salaries.

Business

An organization or enterprising entity engaged in commercial, industrial, or professional activities with the aim of generating profits.

Umbrella Liability

A package of several kinds of insurance.

Q1: Sixteen-year old Jason drank two beers at

Q15: Fargus Corporation owned 51% of the voting

Q30: Strickland Company sells inventory to its parent,

Q36: Perry Company acquires 100% of the stock

Q45: Pell Company acquires 80% of Demers Company

Q50: In a situation where the investor exercises

Q69: When a company applies the initial value

Q93: Virginia Corp. owned all of the voting

Q103: Pepe, Incorporated acquired 60% of Devin Company

Q106: The following information has been taken from