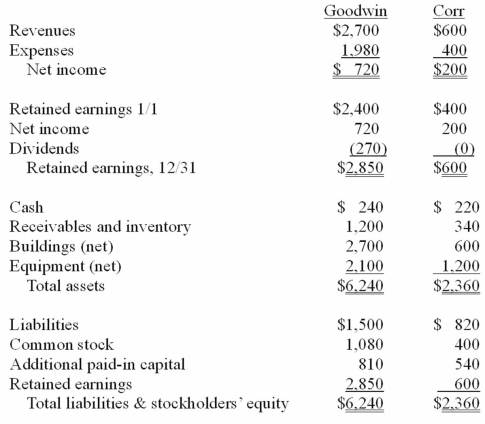

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated expenses for 20X1.

Definitions:

Raise Request

A formal or informal petition for an increase in salary or wages.

Management

The process of planning, organizing, leading, and controlling resources to achieve organizational goals effectively and efficiently.

Attractive Offer

A proposal from a seller that presents significant value or advantage, making it appealing to potential buyers.

Disagreement Value

The value that each party in a negotiation believes they can obtain if the current negotiations dissolve without an agreement.

Q6: Treatment efficacy refers to<br>A)Keeping the promise to

Q10: Six-year old James was referred to the

Q10: Twelve-year old Kevin's conversations contain few specific

Q12: Normative data on speech development reflect lists

Q25: The financial statements for Jode Inc. and

Q43: Pritchett Company recently acquired three businesses, recognizing

Q44: Webb Company owns 90% of Jones Company.

Q77: On 4/1/09, Sey Mold Corporation acquired 100%

Q95: When the fair value option is elected

Q106: Which statement is true concerning unrealized profits