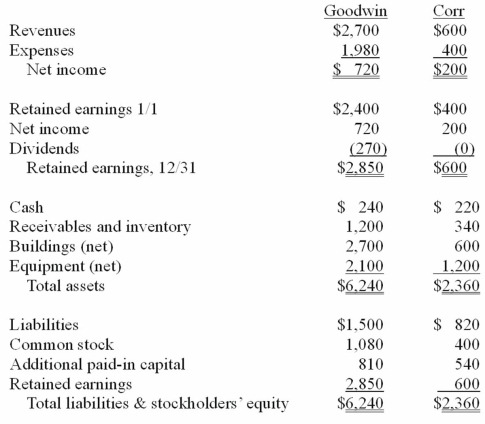

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated equipment (net) account at December 31, 20X1.

Definitions:

Static Tasks

Work or duties that are consistent and unchanging over time, often repetitive in nature.

Piece Rate

A pay system in which employees are paid based on the amount of work they produce, such as the number of items made or tasks completed.

Plastic Toys

Manufactured playthings made from various types of plastic, often designed for children's entertainment and education.

Employee Stock Plans

Programs offered by companies allowing employees to purchase shares at a discount or receive stock as part of their compensation package.

Q4: The five components of language are distinct

Q31: On January 1, 2011, Jackie Corp. purchased

Q32: Why is push-down accounting a popular internal

Q65: On January 1, 2011, Pride, Inc. acquired

Q68: How would you account for in-process research

Q73: Which one of the following is a

Q75: Watkins, Inc. acquires all of the outstanding

Q83: Bauerly Co. owned 70% of the voting

Q111: On January 1, 2011, Bangle Company purchased

Q115: Renfroe, Inc. acquires 10% of Stanley Corporation