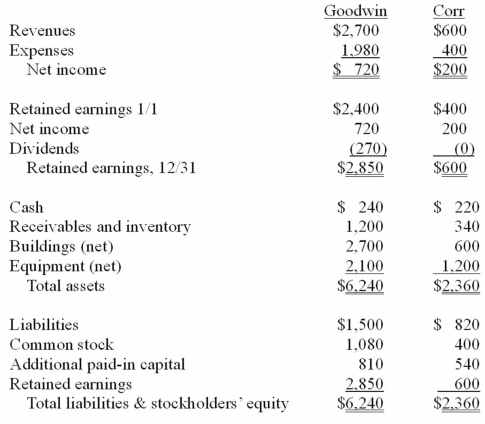

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated common stock account at December 31, 20X1.

Definitions:

Borrowing

The act of obtaining funds from another party with the promise of repayment at a later date, often with interest.

Shareholders

Individuals or entities that own shares in a corporation, giving them ownership interests.

Financial Management

The strategic planning, controlling, organizing, and monitoring financial resources to achieve an organization's goals and objectives.

Current Value

The present worth of an asset or company based on market prices, as opposed to historical cost or book value; often used in gauging financial performance.

Q6: Dialect<br>A)Phonological and vocal characteristics of a spoken

Q11: The types of services provided by audiologists

Q12: The focus of evidence-based practice is to

Q13: Children who do not effectively use early

Q16: Velopharyngeal insufficiency results from inappropriate articulation patterns.

Q51: The financial balances for the Atwood Company

Q61: All of the following statements regarding the

Q63: Which of the following statements is true

Q68: MacDonald, Inc. owns 80 percent of the

Q74: Pot Co. holds 90% of the common