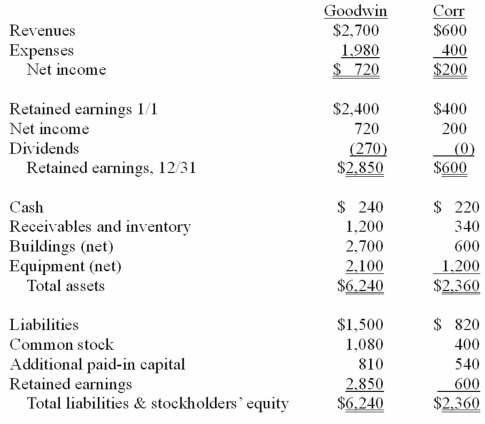

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated liabilities at December 31, 20X1.

Definitions:

Useful Life

The estimated duration that an asset is expected to be functional and economically feasible for use in operations, affecting depreciation calculations.

Outdated

Refers to information, technology, or methods that are no longer current, useful, or in use.

Straight-Line Method

A method of calculating depreciation or amortization by evenly spreading the cost over an asset's useful life.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the decrease in the asset's value over time.

Q4: Learning to read and write places extreme

Q9: The speech-language pathologist decides to participate in

Q12: Beatty, Inc. acquires 100% of the voting

Q14: When Maria has a cold,her sinuses often

Q46: Jans Inc. acquired all of the outstanding

Q63: Stark Company, a 90% owned subsidiary of

Q81: Caldwell Inc. acquired 65% of Club Corp.

Q88: These questions are based on the following

Q97: On January 1, 2010, Jannison Inc. acquired

Q110: On January 1, 2009, Nichols Company acquired