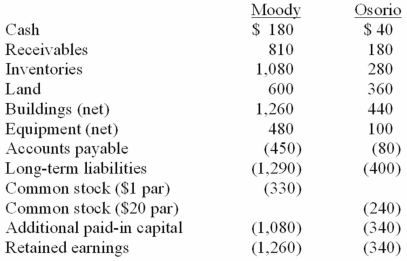

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

What amount was recorded as the investment in Osorio?

Definitions:

Nominal Group Technique

The Nominal Group Technique is a structured method for group brainstorming that encourages contributions from all participants and is used to generate and prioritize ideas.

Equal Participation

A principle ensuring that all members of a group or society have the same opportunities to participate in decision-making processes and activities.

Delphi Technique

A method of gathering expert opinions and achieving consensus through a series of questionnaires and iterative feedback.

Research Chef

A research chef is a professional who combines culinary arts and food science to develop new recipes, products, and technologies in the food industry.

Q3: Following are selected accounts for Green Corporation

Q14: Membership in the National Student Speech-Language-Hearing Association

Q15: Language assessment guides language intervention.

Q56: An investee company incurs an extraordinary loss

Q59: Pell Company acquires 80% of Demers Company

Q99: Gentry Inc. acquired 100% of Gaspard Farms

Q100: How are intra-entity inventory transfers treated on

Q102: Parent Corporation loaned money to its subsidiary

Q114: Wilson owned equipment with an estimated life

Q116: Norek Corp. owned 70% of the voting