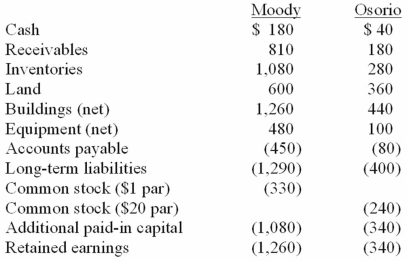

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

What amount was recorded as goodwill arising from this acquisition?

Definitions:

Misinformation

The spread of false or inaccurate information, intentionally or unintentionally, which can mislead people.

Health Insurance

A form of insurance coverage that typically pays for an insured individual's medical and surgical expenses.

Medical Attention

The professional care or treatment provided by healthcare professionals to address health issues or injuries.

Alternative Medicine

Health care practices and products used instead of conventional medicine, often lacking in scientific validation.

Q5: Variations in how we swallow will occur

Q6: When consolidating a subsidiary under the equity

Q10: Researchers decide to determine the prevalence of

Q33: On January 1, 2010, Palk Corp. and

Q36: Perry Company acquires 100% of the stock

Q56: Which of the following internal record-keeping methods

Q77: An example of a difference in types

Q108: When Jolt Co. acquired 75% of the

Q108: Push-down accounting is concerned with the<br>A) impact

Q123: Varton Corp. acquired all of the voting