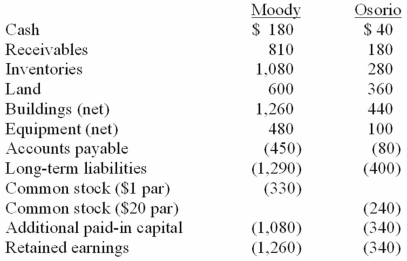

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated additional paid-in capital at date of acquisition.

Definitions:

Epidural Analgesia

A regional anesthesia technique that involves injecting anesthetic near the spinal cord in the epidural space to relieve pain, often during childbirth.

Advance Directive

A legal document in which a person specifies what actions should be taken for their health if they are no longer able to make decisions due to illness or incapacity.

Ethical Committee

A group responsible for ensuring that research and practices adhere to established ethical standards, often found in medical and academic institutions.

Extraordinary Resuscitation

Advanced and often aggressive medical interventions used in attempts to restore life in patients with critical illnesses or injuries.

Q3: Shaun's speech is unintelligible.All aspects of his

Q6: Treatment efficacy refers to<br>A)Keeping the promise to

Q6: Group treatment for patients with aphasia is

Q12: Culture and ethnicity do not play a

Q15: A communication difference is not always a

Q45: Pell Company acquires 80% of Demers Company

Q62: On April 7, 2011, Pate Corp. sold

Q80: Presented below are the financial balances for

Q87: Royce Co. acquired 60% of Park Co.

Q107: When is the gain on an intra-entity