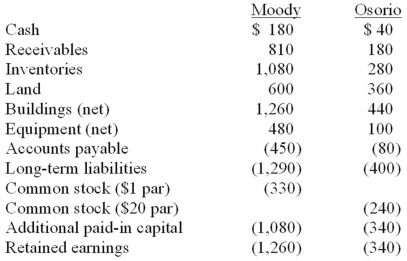

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated cash after recording the acquisition transaction.

Definitions:

Nominal

A level of measurement that categorizes data but does not rank them.

Dummy Variables

Variables created to include categorical data in regression models by converting categories to a binary form (0 or 1), representing the presence or absence of some categorical effect.

Nominal Characteristic

A qualitative attribute of data that categorizes but does not imply any quantitative ordering or measure.

Nominal Variables

Factors that denote classifications without any inherent hierarchy or sequence.

Q2: James heard the sentence "the player who

Q7: Incidence refers to the number of new

Q10: High vocal pitch is related to<br>A)Slow moving,short,thick

Q11: The majority of voice disorders are preventable.

Q20: According to the FASB ASC regarding the

Q30: During January 2010, Wells, Inc. acquired 30%

Q39: On January 4, 2010, Harley, Inc. acquired

Q81: Presented below are the financial balances for

Q82: On January 4, 2010, Trycker, Inc. acquired

Q104: On January 4, 2011, Bailey Corp. purchased