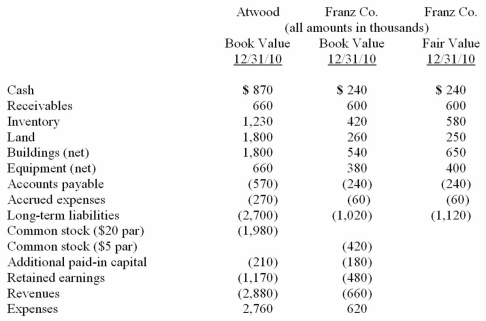

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated revenues at date of acquisition.

Definitions:

U-Shaped Average

This term seems unclear; possibly referring to the 'U-shaped' curve of the average cost, which decreases, reaches a minimum, and then increases with production volume.

Price Elasticity

Evaluating how price changes for a good translate into variations in consumer interest.

Cost of Entry

The initial capital and expenses required to start a business or enter a market.

Economies of Scale

The cost advantage achieved by an enterprise when production becomes efficient, as the scale of the operation increases.

Q4: Why do intra-entity transfers between the component

Q5: Julie is a 2-year old with a

Q8: The success of AAC depends on the

Q11: The most frequently occurring dysarthria is spastic

Q15: Cayman Inc. bought 30% of Maya Company

Q19: Specific genes have been associated with deafness

Q41: Steven Company owns 40% of the outstanding

Q106: Following are selected accounts for Green Corporation

Q108: On January 4, 2010, Harley, Inc. acquired

Q113: On January 1, 2011, Jordan Inc. acquired