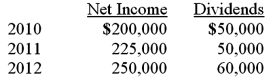

On January 1, 2010, Mehan, Incorporated purchased 15,000 shares of Cook Company for $150,000 giving Mehan a 15% ownership of Cook. On January 1, 2011 Mehan purchased an additional 25,000 shares (25%) of Cook for $300,000. This last purchase gave Mehan the ability to apply significant influence over Cook. The book value of Cook on January 1, 2010, was $1,000,000. The book value of Cook on January 1, 2011, was $1,150,000. Any excess of cost over book value for this second transaction is assigned to a database and amortized over five years. Cook reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout the years:  On April 1, 2012, just after its first dividend receipt, Mehan sells 10,000 shares of its investment.

On April 1, 2012, just after its first dividend receipt, Mehan sells 10,000 shares of its investment.

How much income did Mehan report from Cook during 2010?

Definitions:

Cost Leadership

A strategic approach where a company aims to become the lowest-cost producer in its industry, often leading to competitive pricing.

Product Differentiation

A strategy that businesses use to highlight the unique features and benefits of their products or services, distinguishing them from competitors in the market.

Competitive Scope

Refers to the broadness of a company's target market within its industry, ranging from niche to global markets.

Niche Category

A specialized segment of the market for a particular kind of product or service.

Q3: TDD is a keyboard device that allows

Q4: The acoustics and perception of sound constitutes

Q5: Eighteen year-old Bill was in a car

Q11: The majority of voice disorders are preventable.

Q17: During the speech assessment,Emily sometimes said 'puck'

Q18: On January 4, 2010, Harley, Inc. acquired

Q34: Flintstone Inc. acquired all of Rubble Co.

Q88: What is the justification for the timing

Q94: On January 4, 2011, Watts Co. purchased

Q318: Which of the following is one recommendation