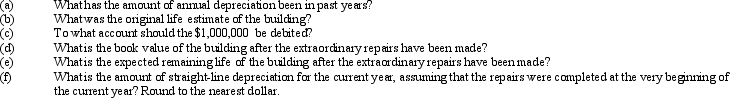

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate.The original cost of the building was $6,552,000,and it has been depreciated by the straight-line method for 25 years.Estimated residual value is negligible and has been ignored.The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Definitions:

Q13: The following data were gathered to use

Q25: Federal unemployment compensation taxes that are not

Q103: The initial owners of stock of a

Q118: When accounting for uncollectible receivables and using

Q122: The following journal entries would be used

Q130: Equipment purchased at the beginning of the

Q143: When the market rate of interest was

Q146: A corporation has 50,000 shares of $25

Q156: A $300,000 bond was redeemed at 104

Q166: Before a stock dividend can be declared