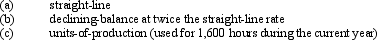

Machinery is purchased on July 1 of the current fiscal year for $240,000.It is expected to have a useful life of 4 years,or 25,000 operating hours,and a residual value of $15,000.Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

(Round the answer to the nearest dollar. )

Definitions:

Work in Process

Inventory in the production process but not yet completed, representing part of a company's current assets.

Indirect Materials

Indirect materials are materials used in the production process that do not directly become part of the final product and are not easily traceable to specific products or units produced.

Manufacturing Overhead

All manufacturing costs that are not direct materials or direct labor, such as maintenance, utilities, and depreciation on manufacturing equipment.

Work in Process

Goods that are in various stages of the production process but are not yet completed.

Q24: The charter of a corporation provides for

Q31: A capital lease is accounted for as

Q53: Patents are exclusive rights to manufacture,use,or sell

Q53: The journal entry a company uses to

Q54: Sarbanes-Oxley requires companies to maintain strong and

Q71: A check drawn by a company in

Q110: If a company borrows money from a

Q113: Any unamortized premium should be reported on

Q148: Which of the following would appear as

Q152: Bonds are sold at face value when