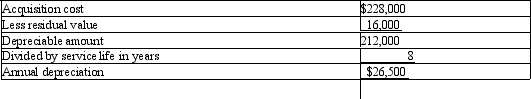

On July 1st,Harding Construction purchases a bulldozer for $228,000.The equipment has a 8 year life with a residual value of $16,000.Harding uses straight-line depreciation.

(a)Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b)Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c)Calculate the last year's depreciation expense and provide the journal entry for the last year.

Annual depreciation is:

Definitions:

Painful Medical Procedures

Medical interventions or treatments that cause physical discomfort or pain to the patient.

Final Moments

The last phase or moments of an event or a person's life, often marked by significant experiences or revelations.

Social Influence

The effect of other people's thoughts, feelings, or actions on someone's behavior, choices, or attitudes, often leading to changes in those behaviors or beliefs.

Unhypnotized Adults

Individuals who are not currently under hypnosis, meaning they are fully aware and not in an altered state of consciousness.

Q10: Use the following information to answer the

Q16: On January 1,2011,Zero Company obtained a $52,000,four-year,6.5%

Q52: The Weber Company purchased a mining site

Q60: Receipts from cash sales of $3,200 were

Q72: A disadvantage of the corporate form of

Q96: Williams Company acquired machinery on July 1,2009,at

Q128: Which of the following statements concerning taxation

Q159: On April 10,Maranda Corporation issued for cash

Q168: When a borrower receives the face amount

Q174: The amount of deposits in transit is