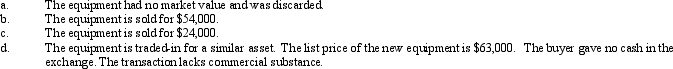

Equipment acquired at a cost of $126,000 has a book value of $42,000.Journalize the disposal of the equipment under the following independent assumptions.

Journal

Definitions:

Taxable Income

The amount of income used to determine how much tax an individual or a corporation owes to the government.

Federal Income Tax

A charge imposed by the IRS on the yearly income of individuals, corporations, trusts, and various legal bodies.

Book Depreciation

The method of allocating the cost of a physical or tangible asset over its useful life for accounting and tax purposes.

Earnings and Profits

A measure used in corporate tax to assess the ability of a corporation to make distributions to its shareholders that are not considered a return of capital.

Q1: Allowance for Doubtful Accounts is classified as

Q45: What is the total stockholders' equity based

Q79: At the end of a period, (before

Q95: On June 1,2014,Aaron Company purchased equipment at

Q106: A compensating balance occurs when a bank

Q106: The balance in Retained Earnings at the

Q123: When the board of director's declares a

Q127: Revising depreciation estimates does affect the amounts

Q159: During the first year of operations,employees earned

Q168: Sorenson Co. ,is considering the following alternative