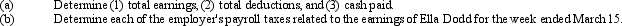

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour,with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% on maximum earnings of $100,000.Medicare tax:

1.5% on all earnings.

State unemployment: 3.4% on maximum earnings of $7,000;on employer

Federal unemployment: 0.8% on maximum earnings of $7,000;on employer

Definitions:

Audience Objections

The concerns, questions, or complaints raised by an audience or market in response to a proposal, presentation, or product.

Emotional Benefit

The positive emotional impact or satisfaction gained from using a product, service, or engaging in an activity, contributing to overall well-being or happiness.

Key Selling Points

Crucial attributes or advantages of a product or service that make it appealing to potential buyers.

Indirect Approach

A method of communication or persuasion that is not straightforward, often involving subtlety or implication rather than direct statements.

Q5: When referring to a note receivable or

Q17: The stock dividends distributable account is listed

Q30: The term applied to the amount of

Q38: On December 31,Strike Company has decided to

Q42: Numbers of times interest charges earned is

Q73: For each of the following scenarios,indicate the

Q112: Other than accounts receivable and notes receivable,name

Q127: Receivables not currently collectible are reported in

Q132: Falcon Company acquired an adjacent lot to

Q154: If bonds are issued at a premium,the