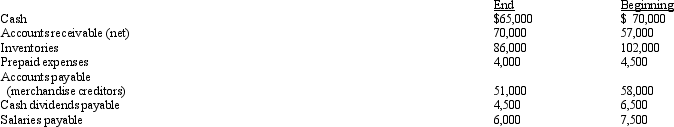

The net income reported on an income statement for the current year was $63,000.Depreciation recorded on fixed assets for the year was $24,000.Balances of the current asset and current liability accounts at the end and beginning of the year are listed below.Prepare the cash flows from operating activities section of a statement of cash flows using the indirect method.

Definitions:

P/E Ratio

The ratio of a company's share price to its earnings per share, indicating the value the market places on its earnings.

Earnings Retention Ratio

The proportion of net earnings not paid out as dividends but retained by the company to be reinvested in its core business, or to pay debt.

Dividend Payout Ratio

The percentage of net income a firm pays to its shareholders as dividends.

P/E Ratios

The Price-to-Earnings Ratio, a valuation metric comparing a company's current share price to its per-share earnings.

Q4: A company has 10,000 shares of $10

Q30: A balance sheet shows cash,$75,000;marketable securities,$115,000;receivables,$150,000 and

Q39: The journal entry Stanton will record on

Q92: As a psychotherapist,Dr.Buist does not analyze people's

Q127: If the accounts receivable turnover for the

Q143: In computing the rate earned on total

Q181: Which of the following items appear on

Q204: EMDR seems to be effective for treating<br>A)

Q389: To facilitate diagnostic reliability,the DSM-5 typically bases

Q393: Although Ethan is actually doing very well