Activity-based costing in a nonmanufacturing environment.Crystal Clear,Inc. ,is a pool service.The company originally specialized in serving residential clients but has recently started contracting for work with larger commercial clients,like hotels.Dudley Waters,the owner,is considering reducing residential services and increasing commercial pool service.Five field employees worked a total of 15,000 hours last year-10,000 on residential jobs and 5,000 on commercial jobs.Wages were $8 per hour for all work done.Direct materials used were minimal and are included in overhead.All overhead is allocated on the basis of labor hours worked,which is also the basis for customer charges.Because of greater competition for commercial accounts,Mr.Waters can charge $20 per hour for residential work,but only $17 per hour for commercial work.

Required:

a.If overhead for the year was $75,000,what were the profits of commercial and residential service using labor hours as the allocation base?

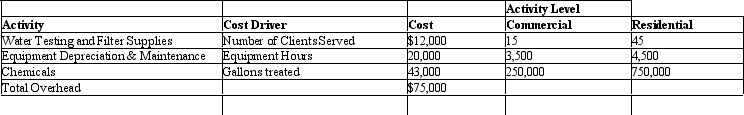

b.Overhead consists of office supplies,garden supplies,and depreciation and maintenance on equipment.These costs can be traced to the following activities:

Recalculate profits for commercial and residential services based on these activity bases.

c.What recommendations do you have for management?

Definitions:

U.S. States

U.S. States are the fifty administrative divisions of the United States, each with its own government and jurisdiction under the federal system.

Infant Mortality Rate

The rate at which babies under one year old die, often calculated per 1,000 live births.

United States

A country in North America consisting of 50 states and a federal district, known for its large economy and diverse population.

Fairly High

A relative measure indicating a level or amount that is somewhat above average or normal.

Q5: Discuss why cost-volume-profit analysis could be useful

Q6: Shenandoah Company<br>Shenandoah Company is considering the introduction

Q6: In comparison to an activity-based costing system,traditional

Q32: Which of the following statements is true

Q38: The service department cost allocation methodology that

Q50: Is there an optimal transfer pricing policy

Q51: Describe how analysts estimate cost behavior using

Q61: The total cost (TC)of an item is

Q93: The time a company spends responding to

Q125: Which of the following statements is true