Activity-based costing in a nonmanufacturing environment.Green Thumb,Inc. ,is a lawn care service.The company originally specialized in serving residential clients but has recently started contracting for work with larger commercial clients.Mr.Green,the owner,is considering reducing residential services and increasing commercial lawn care.Five field employees worked a total of 10,000 hours last year-6,500 on residential jobs and 3,500 on commercial jobs.Wages were $9 per hour for all work done.Direct materials used were minimal and are included in overhead.All overhead is allocated on

the basis of labor hours worked,which is also the basis for customer charges.Because of greater competition for commercial accounts,Mr.Green can charge $22 per hour for residential work,but only $19 per hour for commercial work.

Required:

a.If overhead for the year was $62,000,what were the profits of commercial and residential service using labor hours as the allocation base?

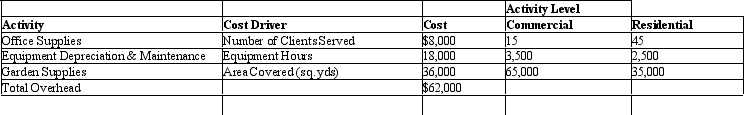

b.Overhead consists of office supplies,garden supplies,and depreciation and maintenance on equipment.These costs can be traced to the following activities:

Recalculate profits for commercial and residential services based on these activity bases.

c.What recommendations do you have for management?

Definitions:

Strategic Alliance

Agreement between firms to cooperate in pursuit of a joint goal.

Joint Goal

A shared objective or aim pursued by two or more parties, typically in a collaborative or partnership context.

Joint Venture

A business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task or undertaking.

Complementary Resources

Assets or resources that when combined with existing company resources can lead to greater value creation or competitive advantage.

Q7: The balanced scorecard is a causal model

Q9: Costs of operating the human resources,accounting,computer support,and

Q23: The costing process that (1)measures each service

Q44: Why do managers use cost behavior patterns?<br>A)to

Q60: Which critical success factor means giving the

Q64: When are cost allocation concepts appropriate?<br>A)only as

Q69: Colorado Furniture<br>Colorado Furniture had the following historical

Q70: Engine Division<br>The Engine Division provides engines for

Q86: Which of the following is the method

Q89: Which of the following is management's challenge