Hightown Company uses a predetermined overhead rate for applying overhead cost to products.Rates for the current year follow:

Variable Overhead Rate: $2.50 per unit

Fixed Overhead Rate: $5.00 per unit

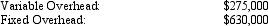

Actual overhead costs:

The company expected to produce 125,000 units during the year,but only produced 120,000.

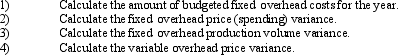

REQUIRED:

Definitions:

Variable Costs

Expenses that change in proportion to the level of production or business activity, such as materials, labor, and energy costs.

Process-Focused

An approach emphasizing the importance of processes in achieving a company's objectives, often through continuous improvement and optimization of workflows.

Repetitive Manufacture

A manufacturing process characterized by the continuous production of high volumes of the same product or component.

Crossover Point

The juncture at which two options, such as production methods or investment choices, yield the same cost or benefit, making them equally preferable.

Q19: Engine Division<br>The Engine Division provides engines for

Q47: In 2016,due to a change in marketing

Q54: Doug's Delivery Company<br>Doug's Delivery Company reports the

Q55: Northstar Timber processes timber into Grade A

Q69: What is Falwell's diluted earnings per share

Q70: Computing equivalent units (Appendix 2.1).The Assembly Department

Q75: The stage of processing when two or

Q76: What can be said of the relationship

Q79: Which of the following are rewards that

Q94: The result of a stock split is:<br>A)A