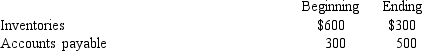

Dooling Corporation reported balances in the following accounts for the current year:

Cost of goods sold was $7,500.What was the amount of cash paid to suppliers?

Definitions:

Swallow Precautions

Strategies and interventions designed to prevent aspiration and choking in individuals with difficulty swallowing, known as dysphagia.

Aspiration

The inhalation of food, liquid, or other substances into the lungs, which can cause choking or serious lung complications.

Critical Thinking

The process of actively analyzing, assessing, synthesizing, evaluating, and reflecting on information to make informed judgments.

Nursing Process

A systematic approach used by nurses to plan and provide individualized patient care, typically involving assessment, diagnosis, planning, implementation, and evaluation.

Q10: Which stage of a product's life cycle

Q12: The primary objective of the statement of

Q20: In 2014,Winn,Inc. ,issued $1 par value common

Q39: Fred's Fine Roasted Coffee<br>Fred's Fine Roasted Coffee

Q60: A decrease in cash dividends payable means

Q70: Big Sky Timber processes timber into Grade

Q88: A company failed to record unrealized gains

Q124: Preferred dividends are subtracted from earnings when

Q148: Alpha Company had the following account balances

Q174: Restricted stock units (RSUs):<br>A)are a grant valued