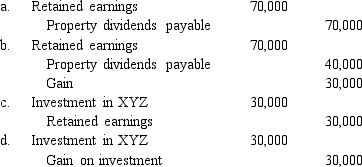

ABC declared a property dividend.The dividend consisted of 10,000 common shares of its investment in XYZ Company.The shares had originally been purchased at $4 per share and had a $1 par value.The value of the shares on the declaration date is $7 per share.What is the first entry that should be recorded related to this dividend?

Definitions:

CPI

Consumer Price Index; a measure that examines the weighted average of prices of a basket of consumer goods and services, typically used as an indicator of inflation.

CPI

Short for Consumer Price Index, a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

Rookie Salary

The initial compensation package awarded to a professional athlete in their first year or season of play.

CPI

Consumer Price Index, a measure that examines the weighted average of prices of a basket of consumer goods and services, typically used as an indicator of inflation.

Q19: A net pension asset is the excess

Q21: On its tax return at the end

Q30: In its first year of operations,Woodmount Corporation

Q38: Under its executive stock option plan,Q Corporation

Q40: At the end of the current year,Newsmax

Q62: Mandatorily redeemable preferred stock is reported as

Q67: Expenditures currently deducted in the tax return

Q72: F Co.declares a 5% stock dividend.If the

Q88: In its 2016 annual report to shareholders,Livey

Q145: How many types of potential common shares