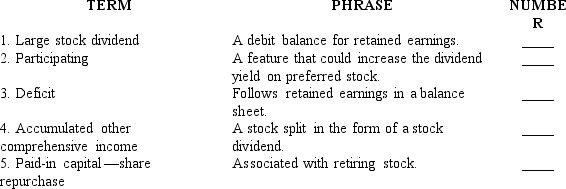

Listed below are five terms followed by a list of phrases that describe or characterize each of the terms.Match each phrase with the number for the correct term.

Definitions:

Deductible

The amount that a taxpayer must pay out-of-pocket before an insurance company will pay any expenses.

Unreimbursed Employee Business Expenses

Expenses employees incur in the course of performing their job that are not reimbursed by the employer.

Itemized Deductions

Expenses allowed by the IRS that can be subtracted from adjusted gross income to reduce taxable income, including mortgage interest, medical expenses, and charitable contributions.

2% Floor

A tax rule that limits the deductibility of certain miscellaneous expenses to only the portion that exceeds 2% of the taxpayer’s adjusted gross income.

Q24: On December 31,2016,Perry Corporation leased equipment to

Q41: The net postretirement benefit liability (APBO minus

Q70: The following information is related to the

Q77: Nash Industries changed its method of accounting

Q80: What events create permanent differences between accounting

Q87: A change to the LIFO method of

Q105: Revenues from installment sales of property reported

Q161: Brown Industries provides postretirement health care benefits

Q177: Consider the following:<br>I.Present value of vested benefits

Q188: Lasagna Corporation has a defined benefit pension