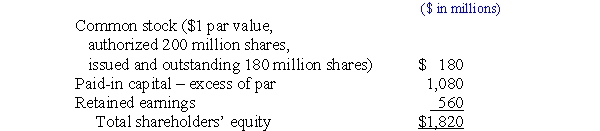

The balance sheet of Messi Services included the following shareholders' equity section at December 31,2016:

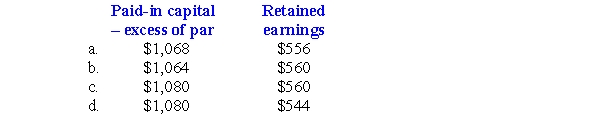

On January 5,2017,Holmes purchased 2 million treasury shares for $9 million.Immediately after the purchase of the shares,the balances in the paid-in capital- excess of par and retained earnings accounts are:

Definitions:

Q15: Amortizing prior service cost for pensions and

Q24: What disclosures for deferred taxes,pertaining to the

Q36: An unrealized gain from marking an investment

Q37: The following information is for Hulk Gyms'

Q37: Differentiate between the projected benefit obligation,the accumulated

Q55: Which of the accounting changes listed below

Q59: Assume that at the beginning of the

Q125: On December 31,2015,Jackson Company had 100,000 shares

Q184: The projected benefit obligation may be less

Q188: Lasagna Corporation has a defined benefit pension