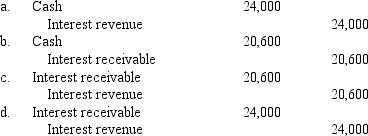

On January 1,2016,Calloway Company leased a machine to Zone Corporation.The lease qualifies as a direct financing lease.Calloway paid $240,000 for the machine and is leasing it to Zone for $34,000 per year,an amount that will return 10% to Calloway.The present value of the minimum lease payments is $240,000.The lease payments are due each January 1,beginning in 2016.What is the appropriate interest entry on December 31,2016?

Definitions:

Fair Values

The selling price of an asset or the payment required to settle a liability in a regulated transaction with market participants, at the time of appraisal.

Net Assets

The total assets of an entity minus its total liabilities, representing the owners' equity.

Fair Market Value

The estimated price at which an asset or service would change hands between a willing buyer and seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.

Carrying Value

The original cost of an asset or liability adjusted for depreciation, amortization, or impairment, reflecting its current book value.

Q1: Of the four criteria for a capital

Q8: If the fair value of a held-to-maturity

Q42: The December 31,2016,balance sheet of MBI Company

Q51: Orpheum Productions has a noncontributory,defined benefit pension

Q56: The lessee normally measures the lease liability

Q57: Listed below are five independent situations.For each

Q68: The unamortized balance of discount on bonds

Q87: If a company chooses the option to

Q99: Yellow Corp.issues 10% bonds.Not including any indirect

Q149: During 2016,Largent Enterprises purchased stock as follows:<br>May