Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

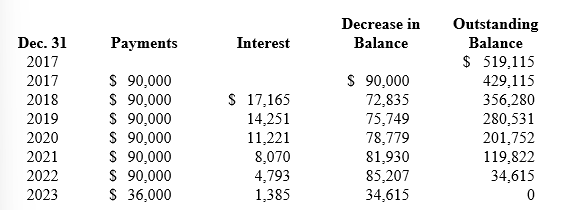

Reagan's lease amortization schedule appears below:

-What is the amount of residual value guaranteed by Reagan to the lessor?

Definitions:

Specified Territory

A clearly defined geographic or conceptual area designated for a specific purpose or assigned to a person or entity.

Transnational Companies

Corporations that operate and have assets in more than one country, often managing production and delivering services in various international locations.

Global Strategies

Plans developed by organizations to operate and compete on a worldwide scale, taking advantage of global opportunities and managing global challenges.

Circumstances

The specific conditions or facts affecting a situation or event at a particular time.

Q19: During its first year of operations,Criswell Inc.completed

Q29: If the fair value of a debt

Q35: Bond X and bond Y both are

Q48: If the leaseback portion of a sale-leaseback

Q51: Using straight-line depreciation for financial reporting purposes

Q68: For the current year ($ in millions),Centipede

Q105: On December 31,2016,the following pension-related data were

Q132: When a corporation acquires its own shares,those

Q133: Which of the following differences between financial

Q152: Giada Foods reported $940 million in income