Use the following to answer questions

Arctic Cat Inc. ,the snowmobile manufacturer,reported the following in its 20X5 annual report to shareholders:

NOTE B - SHORT-TERM INVESTMENTS

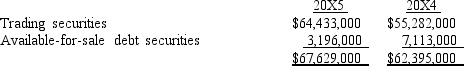

Short-term investments consist primarily of a diversified portfolio of municipal bonds and money market funds and are classified as follows at March 31:

Trading securities consist of $54,608,000 and $41,707,000 invested in various money market funds at March 31,20X5 and 20X4,respectively,while the remainder of trading securities and available-for-sale securities consist primarily of A-rated or higher municipal bond investments.The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000,at March 31,20X5.The unrealized gain on available-for-sale debt securities is reported,net of tax,as a separate component of shareholders' equity.

Trading securities consist of $54,608,000 and $41,707,000 invested in various money market funds at March 31,20X5 and 20X4,respectively,while the remainder of trading securities and available-for-sale securities consist primarily of A-rated or higher municipal bond investments.The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000,at March 31,20X5.The unrealized gain on available-for-sale debt securities is reported,net of tax,as a separate component of shareholders' equity.

Arctic Cat Inc.

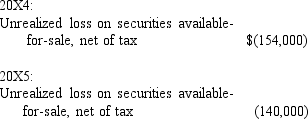

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Years Ended March 31,

Accumulated Other Comprehensive Income changed by the following amounts:

In its 20X4 annual report,Arctic Cat disclosed,"The contractual maturities of available-for-sale debt securities at March 31,20X4,are $3,573,000 within one year and $3,340,000 from one year through five years."

In its 20X4 annual report,Arctic Cat disclosed,"The contractual maturities of available-for-sale debt securities at March 31,20X4,are $3,573,000 within one year and $3,340,000 from one year through five years."

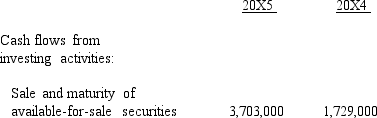

-How much did Arctic Cat actually receive from the sale of available-for-sale securities during 20X5?

Definitions:

Margin of Safety

The difference between actual or projected sales and the break-even point, indicating the buffer amount that sales can decrease before reaching a loss.

Break-even Sales

The amount of revenue required to cover all fixed and variable costs, resulting in neither profit nor loss.

Sales

The total revenue generated from goods or services sold by a company within a specific period.

Break-even Point

The point at which total costs and total revenues are equal, meaning no net loss or gain is incurred.

Q4: The exclusive right to benefit from a

Q8: Listed below are five terms followed by

Q26: Interest may be capitalized:<br>A)On routinely manufactured goods

Q64: Newjohn Company owns stock in several affiliated

Q82: How would the book value of bonds

Q85: The factors that need to be determined

Q85: How do U.S.GAAP and International Financial Reporting

Q112: Briefly explain the differences between U.S.GAAP and

Q137: Damon,Inc. ,acquired 25% of Jolie Enterprises for

Q155: On January 1,2016,Everglade Company purchased the following