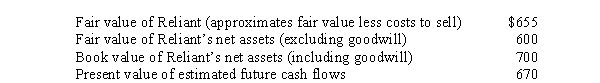

Kingston Corporation has $95 million of goodwill on its books from the 2014 acquisition of Reliant Motors.At the end of its 2016 fiscal year,management has provided the following information for its required goodwill impairment test ($ in millions):

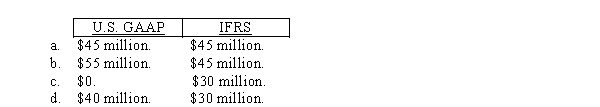

Assuming that Reliant is considered a reporting unit for U.S.GAAP and a cash-generating unit for IFRS,the amount of goodwill impairment loss that Kingston should recognize according to U.S.GAAP and IFRS,respectively,is:

Definitions:

England

England is a country that is part of the United Kingdom, known for its rich history, cultural heritage, and as the birthplace of the English language.

Real Estate Provision

A clause or section in a contract or law that pertains specifically to property transactions, management, or regulations.

Insurance

A financial product that provides protection against potential future losses or damages in exchange for a premium.

Oral Contract

A verbal agreement between parties that is legally binding.

Q21: If a company incurs disposition obligations as

Q24: The choice of cost flow assumption (FIFO,LIFO,or

Q28: Coastal Shores Inc.(CSI)was destroyed by Hurricane Fred

Q36: Unless specific sales criteria are met,the factoring

Q57: Jennings Advertising Inc.reported the following in its

Q71: Briefly explain the differences between the terms

Q98: On September 30,2016,Sternberg Company sold office equipment

Q109: Required: What total interest expense will Morton

Q126: The depreciable base for an asset is:<br>A)Its

Q169: Eastwood Enterprises owns 30,000 shares of the