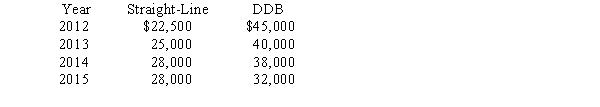

Weaver Textiles Inc.has used the straight-line method to depreciate its equipment since it started business in 2012.At the beginning of 2016,the company decided to change to the double-declining-balance (DDB)method.Depreciation as reported and as it would have been reported if the company had always used DDB is listed below:

Required:

What journal entry,if any,should Weaver make to record the effect of the accounting change (ignore income taxes)? Explain.

Definitions:

Debit

An accounting entry that results in either an increase in assets or a decrease in liabilities on a company’s balance sheet.

Journalizing

The process of recording business transactions in the accounting journals as part of the bookkeeping process.

Transaction

An agreement or exchange between two parties that is recorded and has an economic impact on the finances of a business.

Journal

A detailed record where all financial transactions of a business are initially recorded, before being transferred to the general ledger.

Q3: Pierce Company issued 11% bonds,dated January 1,with

Q29: Required: Compute the January 31 ending inventory

Q34: Which of the following situations would not

Q53: According to International Financial Reporting Standards,all research

Q63: The second step,when using dollar-value LIFO retail

Q68: Changes in the estimates involved in depreciation,depletion,and

Q76: COSO defines internal control as a process,affected

Q98: In periods when costs are rising,LIFO liquidations:<br>A)Can't

Q100: Listed below are 10 terms followed by

Q151: Chez Fred Bakery estimates the allowance for