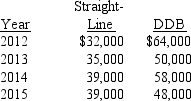

Gonzaga Company has used the double-declining-balance method for depreciation since it started business in 2012.At the beginning of 2016,the company decided to change to the straight-line method.Depreciation as reported and what it would have been reported if the company had always used straight-line is listed below:

Required:

What journal entry,if any,should Gonzaga make to record the effect of the accounting change (ignore income taxes)? Explain.

Definitions:

Quarterly Contributions

Payments or deposits made into a financial account or investment plan every three months.

Annually Compounded

An interest calculation method where interest is added to the principal balance annually, increasing the amount of subsequent interest.

Annually Compounded

Compound interest calculated and added to the principal once a year, affecting the total interest earned or paid.

Nominal Rate

The interest rate stated on a bond or loan before adjusting for inflation or other factors.

Q15: The denominator for the current period's cost-to-retail

Q45: GG Inc.uses LIFO.GG disclosed that if FIFO

Q58: In a period when costs are rising

Q67: Briefly discuss the factors that determine the

Q87: A change from the straight-line method to

Q97: On January 1,2016,Zebra Corporation issued 1,000 of

Q108: What is Nueva's gross profit ratio (rounded)if

Q119: A company that prepares its financial statements

Q131: Goofy Inc.bought 15,000 shares of Crazy Co.'s

Q153: IFRS No.9 is a standard that indicates