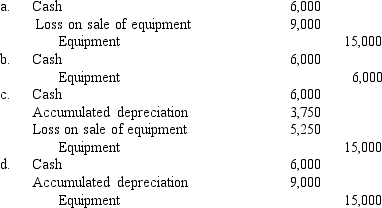

An asset acquired January 1,2016,for $15,000 with an estimated 10-year life and no residual value is being depreciated in an equipment group asset account that has an average service life of eight years.The asset is sold on December 31,2017,for $6,000.The entry to record the sale would be:

Definitions:

T Account

A graphical representation used in accounting to depict the debit and credit sides of a ledger for easier visualization and understanding.

Account Title Column

The section of an accounting ledger or journal used to record the name of the account affected by each transaction.

Accounts Payable

Short-term liabilities or debts a company owes to its suppliers or creditors for goods and services received but not yet paid for.

Deferred Revenue

Income received by a company for goods or services yet to be delivered or performed, recognized as a liability on the balance sheet.

Q18: Ending inventory assuming LIFO in a perpetual

Q24: Providing a monetary rebate program for purchasing

Q24: Listed below are five terms followed by

Q32: The conventional cost-to-retail percentage (rounded)is:<br>A)82.6%.<br>B)66.7%.<br>C)71.9%.<br>D)75.5%.

Q37: A customer of Razor Sharpeners alleges that

Q63: The second step,when using dollar-value LIFO retail

Q82: The FASB's required accounting treatment for research

Q85: Prepare appropriate entry(s)at December 31,2018,and indicate how

Q98: Under IFRS,if it is probable that a

Q141: In its 2016 annual report to shareholders,Bare