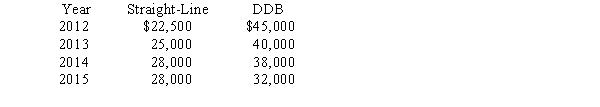

Weaver Textiles Inc.has used the straight-line method to depreciate its equipment since it started business in 2012.At the beginning of 2016,the company decided to change to the double-declining-balance (DDB)method.Depreciation as reported and as it would have been reported if the company had always used DDB is listed below:

Required:

What journal entry,if any,should Weaver make to record the effect of the accounting change (ignore income taxes)? Explain.

Definitions:

LGBTQ Identification

The process or state of recognizing and embracing one's sexual orientation or gender identity as lesbian, gay, bisexual, transgender, queer/questioning.

Immigration Laws

Regulations established by a country to control the right of entry, residence, and citizenship of people from other countries.

Racism

Bias, unfair treatment, or hostility towards individuals of another race, stemming from the conviction that one's own race is superior.

Managing Labor

The process of organizing, directing, and controlling the work and workers in a company or organization, focusing on increasing efficiency and productivity.

Q11: A customer of RoughEdge Sharpeners alleges that

Q24: Providing a monetary rebate program for purchasing

Q41: On January 1,2016,Rupar Retailers purchased $100,000 of

Q42: Heidi Baby Products issued 8% bonds with

Q76: Briefly differentiate between activity-based and time-based allocation

Q97: Cucumber Company concluded at the beginning of

Q110: When the interest payment dates are March

Q117: Briefly explain the financial reporting required when

Q135: Determine the price of a $200,000 bond

Q156: Which of the following is considered a