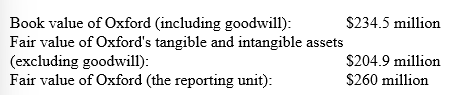

In 2017, Dooling Corporation acquired Oxford Inc. for $250 million, of which $50 million was attributed to goodwill. At the end of 2018, Dooling's accountants derive the following information for a required goodwill impairment test:

-Assume the same facts as above, except that the fair value of Oxford (the reporting unit) is $225 million.

Required: Determine the amount, if any, of the goodwill impairment loss that Dooling must recognize on these assets.

Definitions:

Ideal Size

The optimal dimensions or scale of an object, organization, or system to achieve maximum efficiency or performance.

Corporate Strategy

A comprehensive plan that outlines an organization's overall direction, goals, and approaches to achieve long-term success.

International

Pertaining to relationships between or involving two or more countries.

Merge

The combination of two or more entities into one, through either the acquisition or the pooling of interests.

Q45: Routine transfers of debt and equity investments

Q50: Brown Co.issued $100 million of its 10%

Q52: To the nearest thousand,estimated ending inventory is:<br>A)$55,000.<br>B)$52,000.<br>C)$57,000.<br>D)None

Q71: The annual interest rate on Note A

Q87: A change from the straight-line method to

Q98: In periods when costs are rising,LIFO liquidations:<br>A)Can't

Q101: Company C is identical to Company D

Q110: If a company adopts an accounts receivable

Q122: On January 2,2015,Howdy Doody Corporation purchased 12%

Q126: When the equity method of accounting for