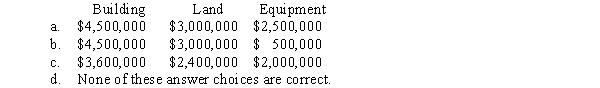

Cantor Corporation acquired a manufacturing facility on four acres of land for a lump-sum price of $8,000,000.The building included used but functional equipment.According to independent appraisals,the fair values were $4,500,000,$3,000,000,and $2,500,000 for the building,land,and equipment,respectively.The initial values of the building,land,and equipment would be:

Definitions:

Total Revenue

The comprehensive amount of financial earnings a company gathers from its sales and services over a designated period.

Elastic Demand Curve

A demand curve that indicates a high responsiveness or sensitivity of quantity demanded to a change in price.

Shell-brand Gasoline

A type of fuel sold under the Shell brand name, which is a global group of energy and petrochemical companies.

Heating Oil

A low viscosity, liquid petroleum product used as a fuel oil for furnaces or boilers in buildings.

Q9: Listed below are five terms followed by

Q17: Unlike the Social Security tax there is

Q26: Which of the following is not true

Q31: Branch Company,a building materials supplier,has $18,000,000 of

Q41: Once selected for existing assets,a company must

Q66: Alliance Software began 2016 with accounts receivable

Q69: In May of 2016,Raymond Financial Services became

Q97: Advocates of accelerated depreciation methods argue that

Q99: Krogstad Corporation bought 1,000 shares of Cole

Q115: Research and development costs for projects other